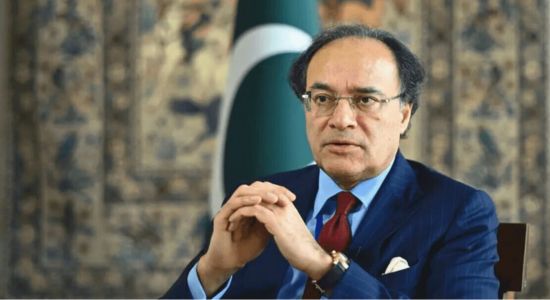

ISLAMABAD, Jan 31 (NNI): Finance Minister Senator Muhammad Aurangzeb Friday congratulated easypaisa digital bank on its successful transformation as Pakistan’s first digital bank, after receiving the coveted digital banking license from the State Bank of Pakistan (SBP).

The celebration took place at a dinner hosted by Irfan Wahab Khan, Chairman of the Board, easypaisa digital bank, and Jahanzeb Khan, President & CEO, easypaisa digital bank, a press release said here Friday.

The function was attended by government officials, including Ali Pervaiz Malik, Minister of State for Finance and Revenue, and Khurram Schehzad, Advisor to the Finance Minister, as well as foreign ambassadors, dignitaries, and business leaders.

Speaking at the occasion, the Finance Minister highlighted this achievement as a significant milestone in Pakistan’s digitalization journey. easypaisa digital bank reached a historic milestone by becoming Pakistan’s first Digital Retail Bank to receive commercial approval from the SBP under its Licensing and Regulatory Framework for Digital Banks.

Addressing the audience, Finance Minister congratulated the easypaisa digital bank leadership, stating: “This is a feather in the cap for Pakistan’s digitalization. Where you are today is truly a milestone to cherish. This transformation will help us shift from traditional cash-based transactions, and it is merely the beginning of the journey—not the finishing line. With Raast and Nadra being centers of digital excellence, it is integral to connect and align these verticals to empower Pakistanis and enhance financial inclusion across the country.”

Chairman of the Board, easypaisa digital bank, Irfan Wahab Khan commented, “The journey from being Pakistan’s first mobile money service to the country’s first digital bank is nothing short of remarkable. This digital banking license empowers us to broaden access to financial services and enhance the lives of millions. As a digital bank with over 50 million registered users, easypaisa digital bank will play a crucial role in delivering innovative and convenient digital financial services to users across Pakistan.”

As a digital bank, easypaisa digital bank is committed to delivering a robust, secure, and seamless banking experience. With best-in-class digital financial solutions, the bank is introducing several firsts in Pakistan, including, Digital term deposits (TDRs), Digital lending options available via mobile, Digital current and savings accounts, Digital wealth management tools, International remittances, Credit and debit cards—all accessible digitally. These groundbreaking offerings aim to expand access to digital banking services for a broader audience.

With 50 million registered users—representing one in four Pakistani adults—a 31% women user base, and 2.7 billion transactions processed in 2024, valued at PKR 9.5 trillion (approximately 9% of Pakistan’s GDP), easypaisa has firmly established itself as a key player in Pakistan’s financial ecosystem. NNI